Estate Tax Amnesty Deadline

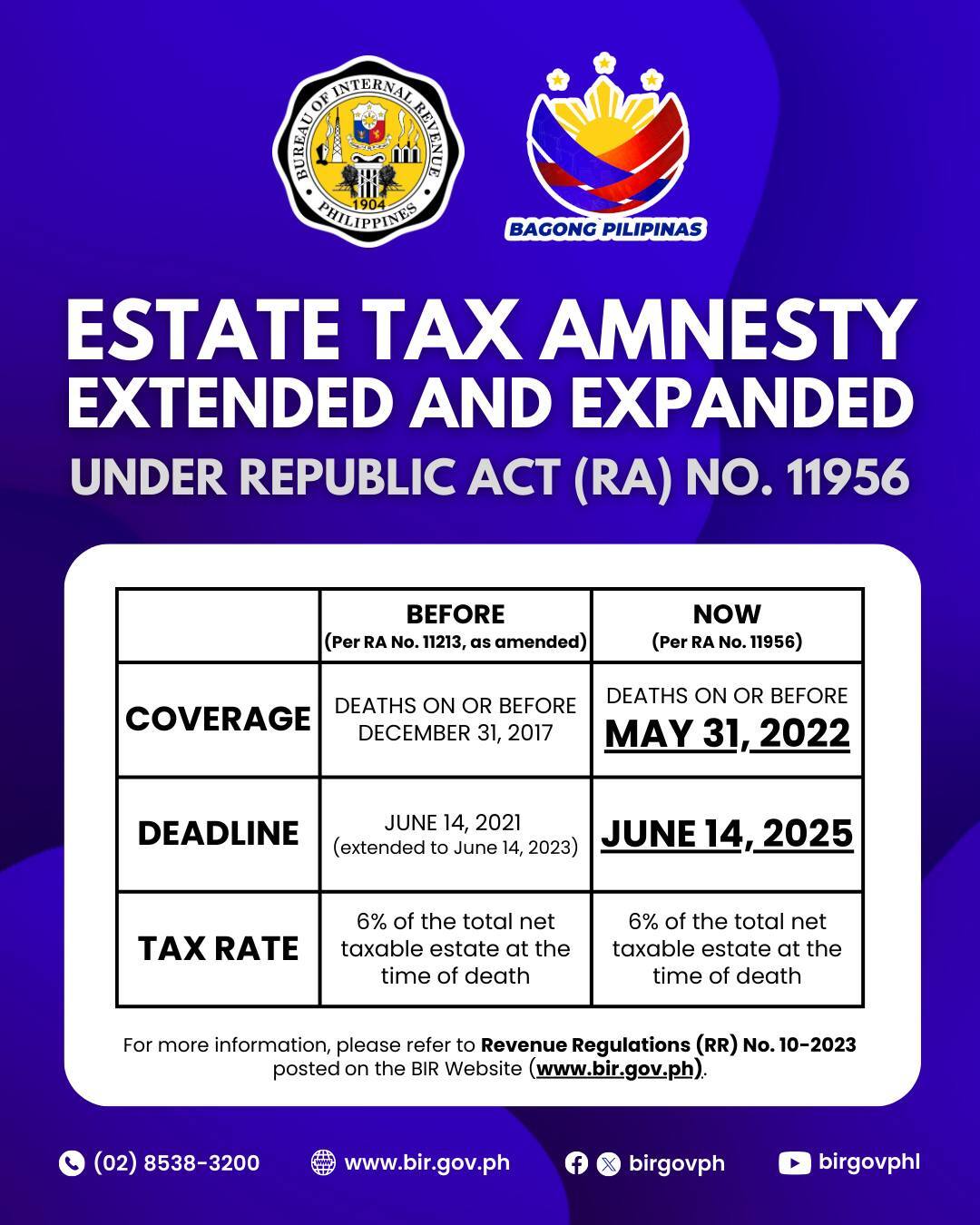

June 14, 2025 is the last day to avail of the Estate Tax Amnesty—just over a month away!

This amnesty eliminates the 25% penalty on the estate tax due and 20% interest per year for unpaid taxes. For large, long-unsettled estates, these charges can add up to thousands of pesos.

Designed to encourage settlement of multi-generational estates, the amnesty applies only to decedents who died on or before May 31, 2022.

Fast-Track Procedure

The Philippine Bureau of Internal Revenue (BIR) confirms that you do not need an Extrajudicial Settlement of Estate (EJS) or court order before paying the tax. Simply file the Estate Tax Amnesty Return (ETAR) and pay the tax by June 14, 2025.

Required Documents for ETAR

- Death certificate of the decedent (apostilled if issued abroad)

- Tax Identification Numbers of the estate and all heirs

- Valid IDs of the heirs

- Certified true copies of all land titles

- Certified copy of real property tax declaration at time of death

- Certificate of No Improvement from the assessor’s office (at time of death)

- Certificate of deposit for bank accounts

- Stock certificates for shares of stock

- Proof of valuation of shares at time of death

Note: Although not mandatory, BIR examiners often request copies of the heirs’ birth certificates.

If your loved one qualifies for the amnesty and their Philippine properties are still in your name, contact us immediately to ensure you meet the deadline.